Body part insurance—it may sound like something out of a Hollywood tabloid, but it’s a real and thriving practice, especially among famous women. In an industry where appearances often mean everything, celebrities, models, and athletes have begun to treat their bodies as financial assets, much like a painter would insure their hands or a singer would insure their voice.

So why are “hot women” insuring their body parts? What body parts are they insuring, and how much are these policies worth? In this article, we will explore not only the most famous cases but also the reasons behind this growing trend, the logistics of body part insurance, and how it ties into both the celebrity culture and broader financial planning.

A Brief History of Body Part Insurance

While it may seem like a modern phenomenon, body part insurance actually dates back to the early 20th century. The concept originated as a way for performers and entertainers to protect the assets that helped them succeed.

The Early Days: Betty Grable and Hollywood Glamour

One of the most iconic early cases is that of Betty Grable, a pin-up model and actress from the 1940s whose legs were famously insured for $1 million by her studio, 20th Century Fox. Grable’s legs were her most famous feature, adored by millions of soldiers during World War II, and the insurance policy was not only a smart business move but also a powerful marketing tool. Her legs were reportedly nicknamed “million-dollar legs,” helping her solidify her status as a cultural icon.

Fast-Forward to Modern Day: From Legs to Lips

As Hollywood evolved, so did the trend of body part insurance. Legs, hands, smiles, and other body parts became valuable assets for entertainers and athletes alike. By the late 20th century, body part insurance was an established practice. Today, women in the entertainment industry, from supermodels to pop stars, have taken this trend to new heights, insuring their physical assets for sums that seem to defy logic.

Why Do Women Insure Their Body Parts?

Before diving into the specifics of who insures what, let’s tackle the big question: why do women in the spotlight insure their body parts?

1. Protecting Their Livelihood

For many entertainers and models, their bodies are their bread and butter. For instance, a model’s legs may be central to her earning potential, while a pop star’s voice is her career. Body part insurance is about securing one’s livelihood. If that key asset is damaged, the financial loss can be devastating.

This type of insurance functions similarly to disability insurance in traditional professions. Just as a surgeon might insure their hands, an actress might insure her face or smile, recognizing that her entire career could hinge on that particular feature.

2. Securing Financial Compensation in Case of Injury

Celebrities can lose millions if they’re unable to work because of injury. The global entertainment industry is worth more than $2 trillion, and entertainers and athletes contribute significantly to that total. If a celebrity loses the ability to perform or appear because of damage to an insured body part, the insurance policy provides financial relief.

3. Personal Branding and Image Protection

For many of these women, their body is their brand. Public image, especially for models, actresses, and singers, is built around appearance. Losing that could mean not just the end of their career but also their relevance in the public eye.

Take Kim Kardashian, for example. Her image and success are deeply tied to her physical appearance, especially her famous curves. It’s not surprising that she’s believed to have insured her buttocks.

Most Common Body Parts Insured by Women

Different celebrities place value on different parts of their bodies, and each body part often correlates with the type of work they do. Here’s a closer look at some of the most commonly insured body parts among famous women.

Legs

Legs have long been a popular choice for insurance, especially among models and dancers.

- Heidi Klum famously insured her legs for $2.2 million. Interestingly, one leg was insured for more than the other because of a scar on one of them. Klum’s legs were central to her career as a supermodel, appearing on runways and in countless ads.

- Rihanna, known for her stunning legs, insured them for $1 million after being named the Celebrity Legs of a Goddess by Gillette. Her legs became part of her overall brand during the early days of her career, making this insurance a wise move.

Buttocks

As body positivity movements have encouraged more diversity in body shapes, buttocks insurance has become a trend.

- Jennifer Lopez reportedly insured her buttocks for $27 million. JLo’s figure has always been a central part of her brand, from her days as a dancer on “In Living Color” to her current role as a singer, actress, and businesswoman.

- Kim Kardashian, arguably one of the most famous women in the world, has reportedly taken out a similar policy for her famous curves. While the exact figure isn’t public, many sources estimate it to be in the multi-million dollar range.

Smile

A radiant smile can be an entertainer’s trademark, and some celebrities have ensured their pearly whites stay protected.

- Julia Roberts, known for her mega-watt smile, has reportedly insured it for $30 million. As an actress whose smile is a defining feature, this type of insurance provides peace of mind.

- America Ferrera, known for her role in “Ugly Betty,” insured her smile for $10 million as part of a partnership with Aquafresh White Trays. Her wide smile became her trademark on the show, so the insurance wasn’t just smart—it was also a branding move.

Breasts

For women in entertainment, especially those in music or film, the shape and appearance of their figure can often be central to their success.

- Dolly Parton, the country music legend, has reportedly insured her breasts for $600,000. As someone who has always embraced her figure and used it as part of her image, it’s no surprise that she’d want to protect these assets.

Hands

Hands are crucial for artists, musicians, and athletes, but even some actors and models have opted to insure their hands, as they play a big role in their careers.

- Rihanna, in addition to her legs, has insured her hands for millions, particularly since they feature in many of her music videos and fashion lines.

Hair

For women who are known for their luscious locks, hair insurance is a smart move.

- Tina Turner, the legendary singer known for her powerful voice and iconic hair, insured her hair for $1 million during her career’s peak. Her look was as much a part of her brand as her voice.

Case Studies of Famous Women and Their Insured Body Parts

Now, let’s dive into some specific, in-depth case studies of famous women who have insured their body parts.

Heidi Klum – Insured Legs ($2.2 Million)

Heidi Klum, one of the most recognizable models of the 1990s and early 2000s, famously insured her legs for $2.2 million. What makes this case especially interesting is that her legs were valued differently—one leg was insured for more than the other because of a scar on one of them.

Klum’s legs were central to her career as a supermodel and TV host on shows like “Project Runway.” Given how much of her public image involved walking runways or standing in front of cameras, leg insurance was a logical choice.

Jennifer Lopez – Insured Buttocks ($27 Million)

Jennifer Lopez, known for her stunning figure and her impressive career in both music and film, reportedly insured her buttocks for $27 million. Lopez’s curves have always been a big part of her brand, and this insurance policy serves as protection for one of her most famous assets.

In interviews, Lopez has often spoken about embracing her curves and how they’ve contributed to her confidence as an entertainer. Given that her buttocks are such a big part of her image, this kind of insurance serves both a practical and symbolic purpose.

Taylor Swift – Insured Legs ($40 Million)

In 2015, Taylor Swift reportedly insured her legs for $40 million. While this figure seems astounding, it’s important to remember that Swift’s long legs have become an iconic part of her look, especially during her live performances.

For Swift, whose tours generate tens of millions of dollars, protecting her legs from injury was a crucial business decision. Given how much physical activity goes into her performances—from running across the stage to dancing in high heels—it’s no surprise she took out such a large policy.

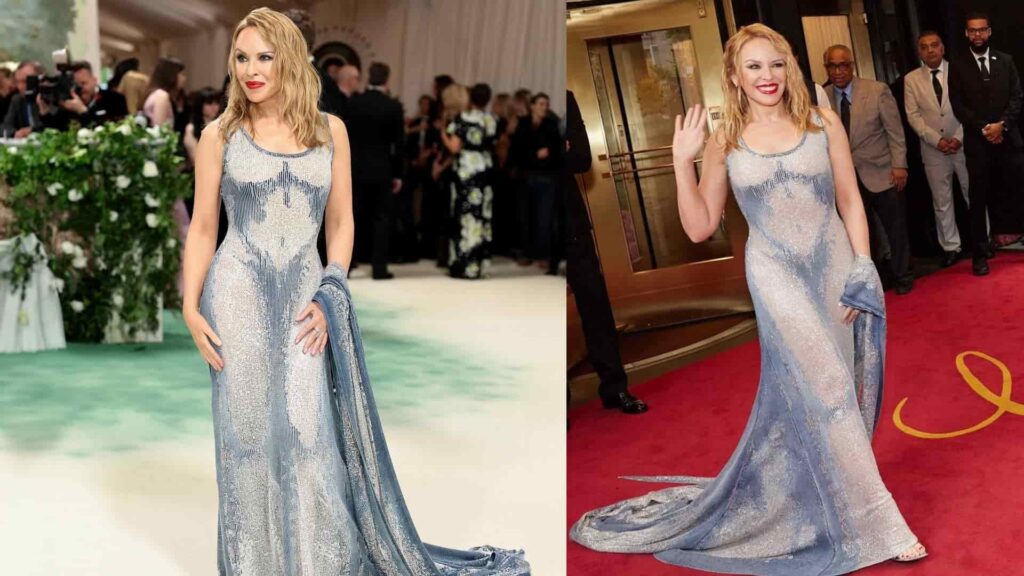

Kylie Minogue – Insured Derriere ($5 Million)

Kylie Minogue, the Australian pop star, insured her derriere for $5 million. Known for her dance routines and music videos, Minogue’s figure was integral to her performances, making this insurance policy a smart financial decision.

How Does Body Part Insurance Work?

You may be wondering, how does one even go about insuring a body part? It’s not as simple as walking into an insurance office and saying, “I’d like to insure my legs.” The process is far more involved and requires a lot of planning, evaluation, and customization. Here’s a breakdown of how the process typically works:

Step 1: Asset Evaluation

The first step in insuring a body part is determining how much it’s worth. This is often a collaborative effort between the celebrity, their financial advisors, and the insurance company. Together, they assess how important the body part is to the person’s career and what kind of financial loss would occur if it were damaged.

Step 2: Risk Assessment

Insurance companies will assess the risk associated with the body part. For example, a model’s legs may be more at risk of injury than a singer’s vocal cords, especially if the model is walking runways or performing stunts.

Step 3: Premiums and Policy Customization

Once the body part has been evaluated and the risk assessed, the insurance company will offer a policy with specific premiums, coverage amounts, and terms. The premiums can vary significantly depending on the risk, the celebrity’s career, and how often the body part is “used” (e.g., a singer’s vocal cords might have a higher premium if they’re constantly performing).

Financial Implications of Body Part Insurance

How Much Does Body Part Insurance Cost?

The cost of body part insurance varies widely depending on the body part being insured and the celebrity involved. For instance, a simple policy for a model’s legs might cost a few thousand dollars a year, while insuring something more complex, like vocal cords, can run into the tens of thousands annually.

For celebrities who earn millions of dollars each year, the premiums are usually a small percentage of their overall income. However, it’s a worthwhile investment, especially for those whose careers rely on their physical appearance.

Claiming Body Part Insurance

Claims can be filed if the insured body part is damaged or injured, leading to an inability to perform or work. In most cases, insurance policies only pay out if the injury directly affects the celebrity’s ability to continue their career.

For instance, if Jennifer Lopez were to suffer an injury that prevented her from performing, her buttocks insurance policy would likely pay out a significant sum to compensate for her loss of income. However, if the injury didn’t affect her ability to perform or work, the policy wouldn’t pay out.

Controversy and Criticism: Is Body Part Insurance Vanity or Smart Business?

While body part insurance is seen as a practical business decision for many in the entertainment industry, it’s not without its critics. Some argue that insuring body parts only adds to the toxic culture of valuing women based on their appearance, especially in Hollywood.

Criticism 1: Reinforcing Objectification

Critics often point to body part insurance as another way the entertainment industry reduces women to their physical attributes. By insuring legs, breasts, or buttocks, some argue that these policies reinforce the notion that women’s bodies are their most important assets—rather than their talents or skills.

Criticism 2: Financial Excess

Others view body part insurance as a symbol of financial excess in Hollywood, where celebrities can afford to spend millions on insuring specific body parts while many everyday people struggle to afford basic health insurance.

Supporters’ Argument: It’s Smart Business

On the flip side, many defend body part insurance as simply a smart business move. Just as a professional athlete might insure their legs, arms, or even hands, entertainers and models are simply protecting the assets that allow them to earn a living.

Additionally, with millions on the line for a career-altering injury, the risk-reward ratio justifies the expense for many celebrities.

Fun Facts and Unusual Body Part Insurance Cases

While legs, smiles, and buttocks are the most commonly insured body parts, some celebrities have taken the concept of body part insurance to new and unusual heights.

- Tina Turner, the legendary singer, insured her legs for $3.2 million.

- Keith Richards, guitarist for the Rolling Stones, reportedly insured his middle finger for $1.6 million, recognizing its importance to his guitar playing.

- America Ferrera‘s smile was insured for $10 million by Aquafresh.

Unconventional Insurance Policies

There are some strange cases too. For example, Troy Polamalu, the former NFL player, insured his hair for $1 million as part of a marketing deal with Head & Shoulders. While hair might seem like an odd choice for an athlete, Polamalu’s long, flowing locks became a defining feature of his brand during his playing days.

Conclusion: Why Body Part Insurance is Here to Stay

The practice of insuring body parts isn’t just a fad. In an industry where image and physical appearance can make or break a career, insuring key body parts is simply a wise financial move. Celebrities understand that their bodies are a major part of their success, and they’re taking steps to protect those assets.

While some may view it as excessive or vain, body part insurance has a legitimate place in the world of entertainment and professional sports. Whether it’s Heidi Klum’s legs, Jennifer Lopez’s buttocks, or Julia Roberts’ smile, these policies are less about vanity and more about protecting an investment.

As long as celebrities continue to rely on their physical appearance for their careers, body part insurance will remain an essential part of the entertainment industry. And for the rest of us? It’s just one more reminder of how the world of fame operates a little differently from our own.